More than a dozen used a tax break for executive stock options to sharply reduce their income taxes last year. For this reason, we can generally describe the tax breaks used by these 55 companies to get their tax expense to zero. pretax income, federal and state income tax paid on that income, and any significant factors affecting tax expense. The Securities and Exchange Commission requires publicly traded companies to disclose U.S.

income, current federal income tax and effective tax rates in 2020 for all 55 of the zero-tax companies are shown in the following table.Ĭompanies’ Low Tax Rates Rely on a Variety of Familiar Tax Breaks

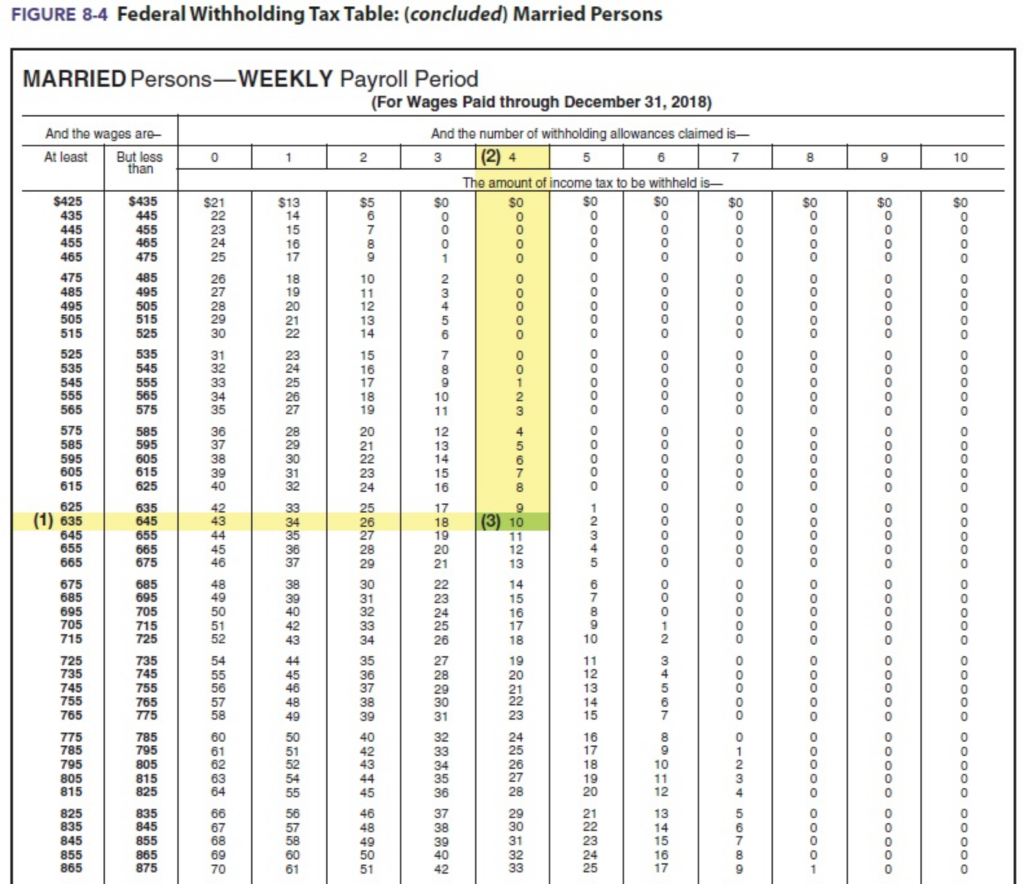

FEDERAL WITHHOLDING TAX TABLE 2020 SOFTWARE

The software company Salesforce avoided all federal income taxes on $2.6 billion of U.S.

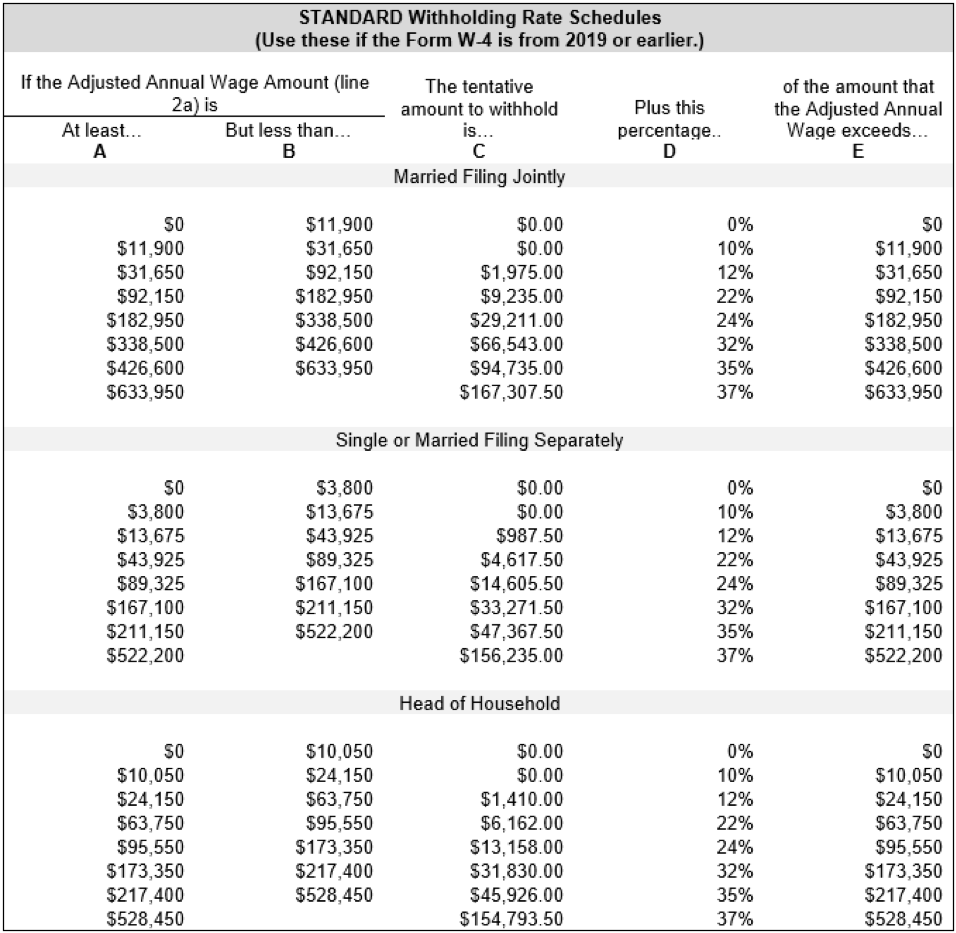

FEDERAL WITHHOLDING TAX TABLE 2020 TV

The cable TV provider Dish Network paid no federal income taxes on $2.5 billion of U.S. pretax income last year, instead enjoying a $109 million tax rebate. The shoe manufacturer Nike didn’t pay a dime of federal income tax on almost $2.9 billion of U.S. pretax income in 2020 and received a rebate of $230 million. The delivery giant FedEx zeroed out its federal income tax on $1.2 billion of U.S. pretax income last year and received a federal tax rebate of $164 million. economy:įood conglomerate Archer Daniels Midland enjoyed $438 million of U.S.

The companies avoiding income taxes in 2020 represent very different sectors of the U.S. Now, with most corporations reporting their third year of results under the new corporate tax laws pushed through by President Donald Trump in 2017, it is crystal clear that the TCJA failed to address loopholes that enable tax dodging-and may have made it worse. A widely cited ITEP analysis of an eight-year period (2008 through 2015) confirmed that federal tax avoidance remained rampant before the TCJA. ITEP reports have documented such tax avoidance since the early years of the Reagan administration’s misguided tax-cutting experiment. corporations have found ways to shelter their profits from federal income taxation. No-Tax Corporations Continue a Decades-Long Trendįor decades, the biggest and most profitable U.S. Some publicly traded corporations paid nothing on profits in their most recent fiscal year but are not included in this report because they are not part of the S&P 500 or Fortune 500. Some companies with unusual fiscal years have not yet filed such reports. All data presented here come directly from the income tax notes of these reports. This report is based on ITEP’s analysis of annual financial reports filed by the nation’s largest publicly traded U.S.-based corporations in their most recent fiscal year. Their total corporate tax breaks for 2020, including $8.5 billion in tax avoidance and $3.5 billion in rebates, comes to $12 billion. Instead, they received $3.5 billion in tax rebates. The 55 corporations would have paid a collective total of $8.5 billion for the year had they paid that rate on their 2020 income. The statutory federal tax rate for corporate profits is 21 percent. pretax income in 2020, according to their annual financial reports. The tax-avoiding companies represent various industries and collectively enjoyed almost $40.5 billion in U.S. corporations, and it appears to be the product of long-standing tax breaks preserved or expanded by the 2017 Tax Cuts and Jobs Act (TCJA) as well as the CARES Act tax breaks enacted in the spring of 2020. This continues a decades-long trend of corporate tax avoidance by the biggest U.S. For more on corporate tax avoidance, read our July 2021 report, Corporate Tax Avoidance Under the Tax Cuts and Jobs ActĪt least 55 of the largest corporations in America paid no federal corporate income taxes in their most recent fiscal year despite enjoying substantial pretax profits in the United States.

0 kommentar(er)

0 kommentar(er)